Build your cashback bonus with 15,000+ participating retail stores country-wide

Most of SA’s major national retailers are part of the bsmart network. That means there is not a product or service that cannot be obtained with the bsmart card.

We are continuously expanding our network of partners and retailers.

Click here for information on how to become a cash back or discount partner.

The perfect companion for

a new generation of shoppers

You earn cashback every time you shop at any of our retail partners. No limits to how much you can earn.

Your cashback bonus accumulates and pays out into your account annually or quarterly – you choose!

Your cashback bonus is yours to do with as you please, whether you want to spend it, save it, or donate it.

You can save twice by swiping your bsmart card with existing loyalty cards like XtraSavings, SmartShopper, WRewards, Clicks Clubcard and more.

Avoid the trap of overextending your credit by settling your full balance every month, or choose a pre-paid card option instead.

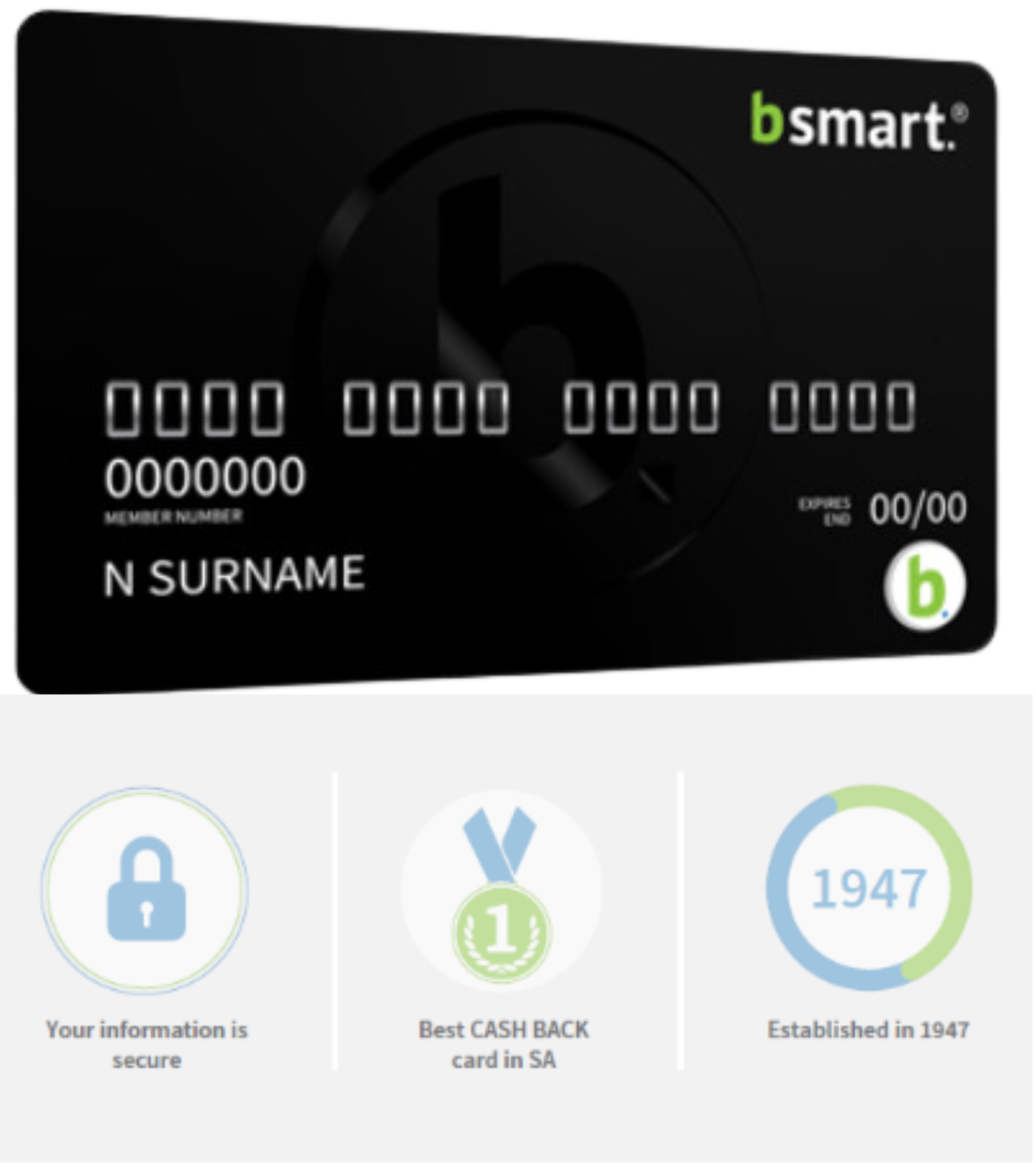

We exist solely for the benefit of our members and cardholders

Your purchases along with over 10,000 other bsmart cardholders gives us the power to negotiate discounts with SA’s top retailers on your behalf. These discounts are paid back to you as a cashback bonus.

Watch the video below if you want to know more about how bsmart works.

You deserve to be rewarded for your loyalty

Imagine the thrill of knowing that every time you buy groceries, clothing, furniture, and more, you’re building a bonus pot just for you!

You earn cashback every time you shop at any of our retail partners. No limits to how much you can earn.

You can save twice by swiping your bsmart card with existing loyalty cards like XtraSavings, SmartShopper, WRewards, Clicks Clubcard and more.

Deals, deals and more deals – we strive to bring you the ‘best price’

Communication with our retail partners and bringing deals to you is what we are good at.

Stay informed by following us on socials:

Members and cardholders join our Facebook community page and subscribe to our newsletter for exclusive deals and competitions.

Your member number gets you access.